Halloween horror story

I received an email earlier this week, as a result of which my jaw is still struggling to defy gravity, writes Neil Thomas, as he reveals a real Halloween horror story.

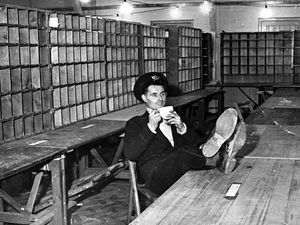

Neil Thomas has a Halloween horror story for you

I received an email earlier this week, as a result of which my jaw is still struggling to defy gravity.

It is a press release headlined "Beware Halloween Scares".

The opening sentence reads: People could be at risk of incurring compensation claims this Halloween because of today's 'where there's blame there's a claim' culture, warns independent financial research company Defaqto.

Thanks for the tip-off, Defaqto. Halloween, we had all imagined in our naivity, to be an opportunity for children to dress up and have fun with pumpkins, so it's useful to know that hovering over such innocent revelry is the ever present threat of a writ.

So, I hear you ask, whence does this threat of legal action loom? Well, from just about everywhere, according to Defaqto's Principal Consultant (General Insurance), Mike Powell.

Mike explains helpfully: "At this spooky time of year, people could get a fright if parents choose to sue because their child tripped up a driveway, injured themselves when playing Halloween games or suffered an allergic reaction when eating home made treats."

Admittedly, a sinister mist has enveloped Halloween in recent years. Along with all the children dressing as witches and wizards and playing their harmless games, a small minority of youngsters have used the trick or treat tradition for slightly more malicious 'fun', often at the expense of the lonely and vulnerable.

Frankly, if such a ratbag grazed his or her knee on the garden rockery, or snapped off their nose in the letterbox they were shouting abuse through, then few will shed tears. Should their venal parents contemplate for one second suing the owner of that rockery or letterbox, a counter claim for trespass, wilful damage and abusive behaviour, backed by an outraged public, should be enough to see them off.

Frankly, if such a ratbag grazed his or her knee on the garden rockery, or snapped off their nose in the letterbox they were shouting abuse through, then few will shed tears. Should their venal parents contemplate for one second suing the owner of that rockery or letterbox, a counter claim for trespass, wilful damage and abusive behaviour, backed by an outraged public, should be enough to see them off.

There are hazards to be negotiated every time we step through our front doors into the outside world, so, you ask, why is Mr Powell making so much of the dangers surrounding Halloween?

If you smelt in all this the rather desperate gambit of a chap trying to sell you insurance you neither need nor can afford, how right you are. For the very next line in the press release is: "Powell warned that people should check the liability cover clause in their buildings and contents insurance to see if they would be covered if a child injures itself on their property or suffers illness".

I don't know about you, but Halloween liability indemnity is, of course, one of the very first things I look for in any prospective insurance policy. Along with Easter egg over-eating protection, St Valentine's Day foolhardy marriage proposal compensation and the soon to be relevant cover against accidently being caught by the flailing hoof of an ascending reindeer, known as the santa clause.

I'm also considering a policy addendum offering a payout for getting caught up in a coastal traffic jam, just to ensure I've got every high day and holiday covered.

Further still, should my 16 year-old son consider civil action because I'm late getting him to rugby practice at Oswestry, I'm protected. I'm also laughing should my 14 year-old son summon the full severity of the law to his cause for my failing to fix his computer to ensure his full five hour quota of internet games of an evening.

I'm even insured against my five year-old son calling in his legal team for my inadvertently barring the doors and windows against the tooth fairy.

I'm even insured against my five year-old son calling in his legal team for my inadvertently barring the doors and windows against the tooth fairy.

Of course, my annual insurance premium is £74,000 a year, but at least I can sleep easily.

Well, in the insurance industry's dreams, at least. In their ideal world we'd all be lashing out £74,000 a year in premiums, their shareholders would own paradise islands and all this ludicrous advertising would have paid off.

Protection against life's disasters is, of course, necessary and desirable. We need a safety net against the floods, fires, lightning strikes and car crashes, the kind of happenings that we often don't have the funds to put right by ourselves.

It's the attempt to whip the nation into a frenzy of paranoia over the increasingly ridiculous that leaves a sour taste. The insurance industry wants us to be fearful and fretful. They're bosses would be delighted if we were all sick with worry. If we have a 'blame and claim' culture, as Powell says, then who is at least partly responsible? The insurance industry with its aggressive marketing, that's who.

"Egg shell in your omelette? Sue that negligent chef for £1 million. Phone 0800 000 000 NOW and remember – no win, no fee".

Statistics suggest that the biggest Halloween danger to children – dressed in black and out in darkness – is from cars. This is a real danger and one we must all be aware of. However Defaqto's Mike Powell clearly suspects many might remain unconvinced by his 'children tripping over, injuring themselves playing games or being laid low by a dodgy pumpkin pie' pitch.

So, with a rather scattergun approach, his press release also suggests: "People who have a dog should also check their pet insurance policy to see if it includes liability cover, as most home insurance policies' liability insurance will exclude cover if your dog injures a child."

I hardly need add that the press release ends: "More information on home insurance and pet insurance can be found at www.defaqto.com".