OBR takes shine off stamp duty move as Budget aims to get UK building

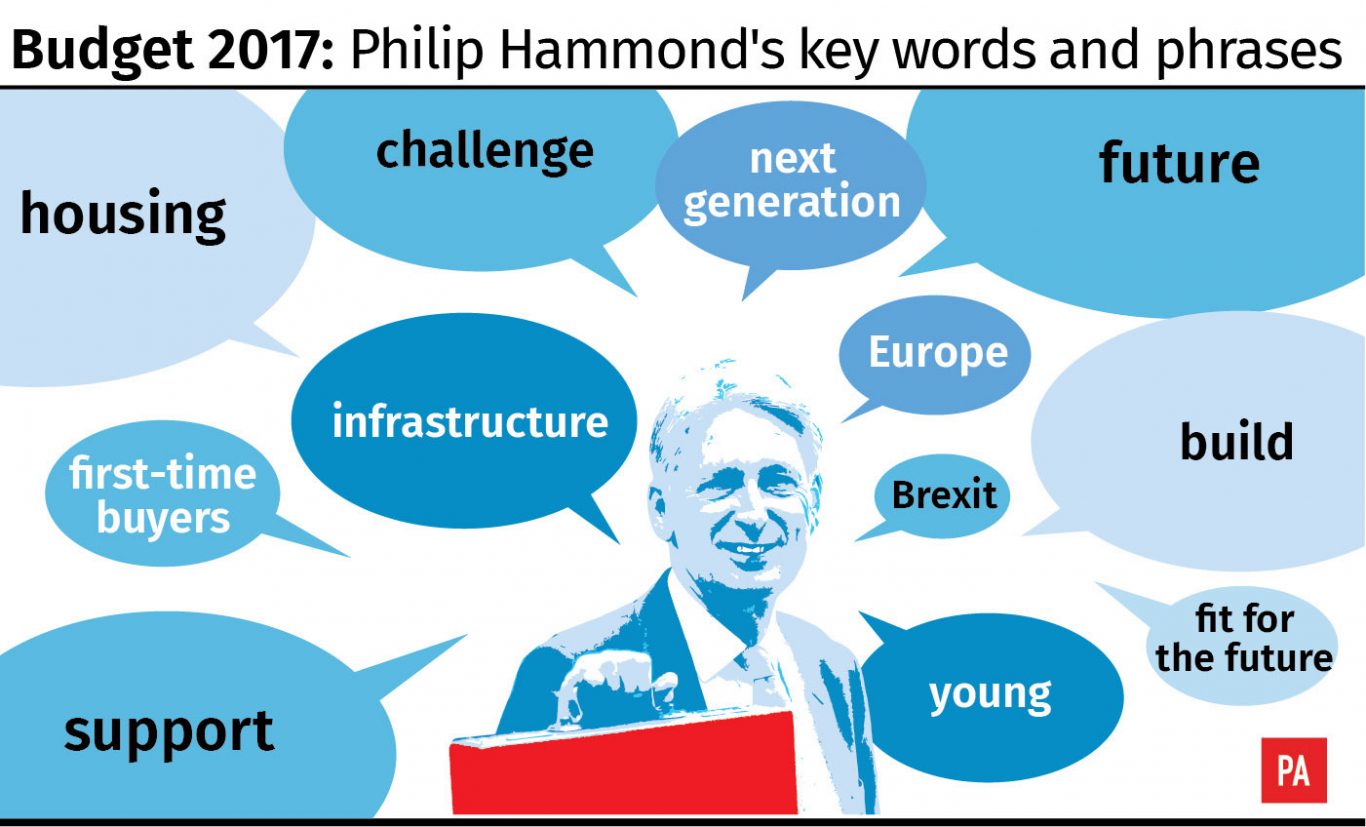

The Chancellor told MPs the Budget laid the foundations for a “global Britain”.

Flagship Budget changes to help young people get onto the property ladder will mainly benefit people who already own homes by forcing up purchase prices, the official economic watchdog has warned.

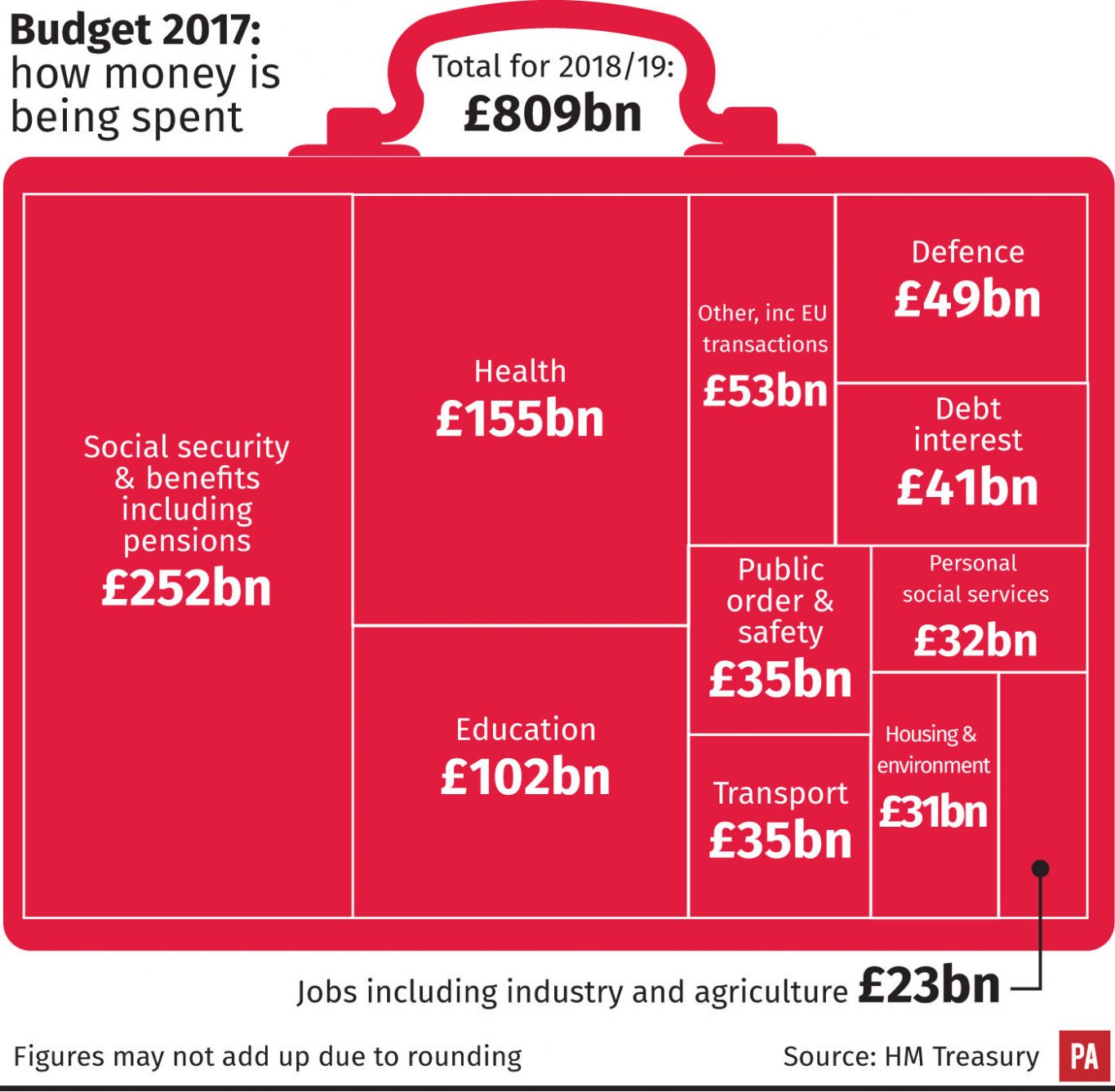

Chancellor Philip Hammond abolished stamp duty for first-time buyers on properties worth up to £300,000 as part of a giveaway Budget package which pumped an additional £25 billion into priorities like housing, infrastructure and the NHS in a bid to build “a Britain fit for the future”.

But the Office for Budget Responsibility took the shine off the move – which the Treasury says will benefit a million home-hunters by an average £1,660 over five years – by predicting it will push up prices by around 0.3%, leaving many first-time buyers paying more than they would have done without the relief.

Treasury sources insisted that the measure, which will also apply to the first £300,000 of homes worth up to half a million pounds, would be a welcome boost to first-time buyers, with 95% seeing a cut in the amount of stamp duty paid and 80% paying none at all.

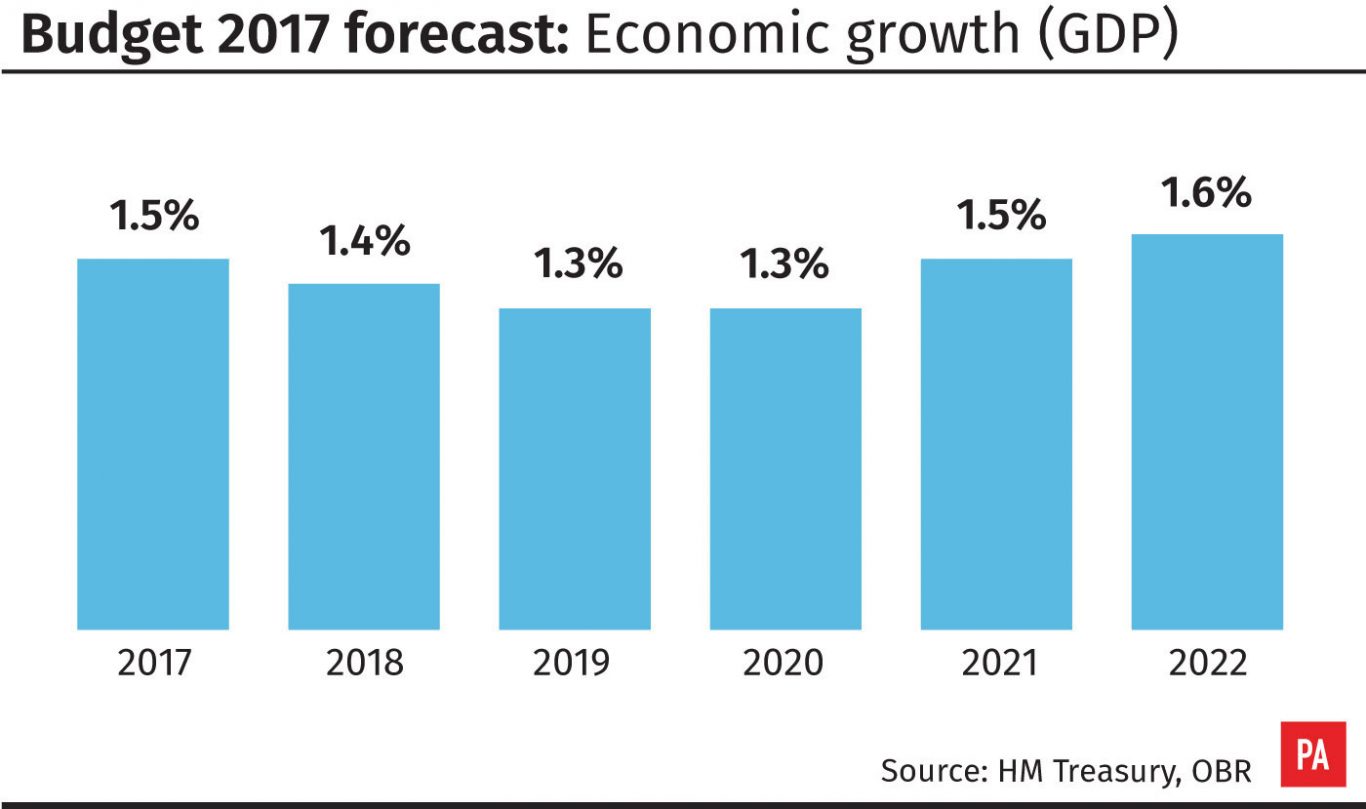

The Chancellor’s room for manoeuvre with his second Budget was limited by grim economic forecasts from the OBR, which downgraded its predictions of GDP growth for each of the next five years as a result of the UK’s poor productivity performance.

The OBR now expects to see GDP grow 1.5% in 2017 – down from the 2% forecast in March – 1.4% in 2018, 1.3% in both 2019 and 2020, before picking back up to 1.5% in 2021, and 1.6% in 2022.

Despite the tight backdrop, Mr Hammond announced significant investments including:

:: An additional £15 billion for housing in a bid to reach the target of building 300,000 extra new homes a year by the mid-2020s

:: An extra £7.5 billion for the NHS over the next five years

:: Another £3 billion to prepare for the impact of Brexit.

Treasury aides insisted Mr Hammond had not forfeited the right to the nickname “fiscal Phil”, as his £25 billion splurge is funded from “headroom” which he had built up in previous announcements.

Despite suggestions that his second Budget of 2017 marked the end of the age of austerity in place during seven years of Conservative-led governments, they stressed that the OBR believes Mr Hammond is still on track to meet his fiscal targets – including balancing the nation’s books by the middle of the next decade.

The extra cash for health includes £2.8 billion for day-to-day spending to help NHS England deal with pressures this winter and make progress on hitting targets, as well as £3.5 billion of capital funding for new equipment and infrastructure. Mr Hammond also promised to fund any increase in health staff pay resulting from current negotiations on improving efficiency.

Institute for Fiscal Studies director Paul Johnson said the 1.4% average annual growth forecast by the OBR over the next five years was “much worse than we have had over the last 60 or 70 years”.

Although Mr Hammond had loosened the purse strings, Britain was still “not getting out of austerity”, with most areas of public spending seeing cuts over the next few years, Mr Johnson told Sky News.

On the OBR figures, borrowing is forecast to be £49.9 billion this year – £8.4 billion lower than predicted at the Spring Budget – and will fall every year to £25.6 billion in 2022-23 – which Mr Hammond said was “its lowest level in 20 years”.

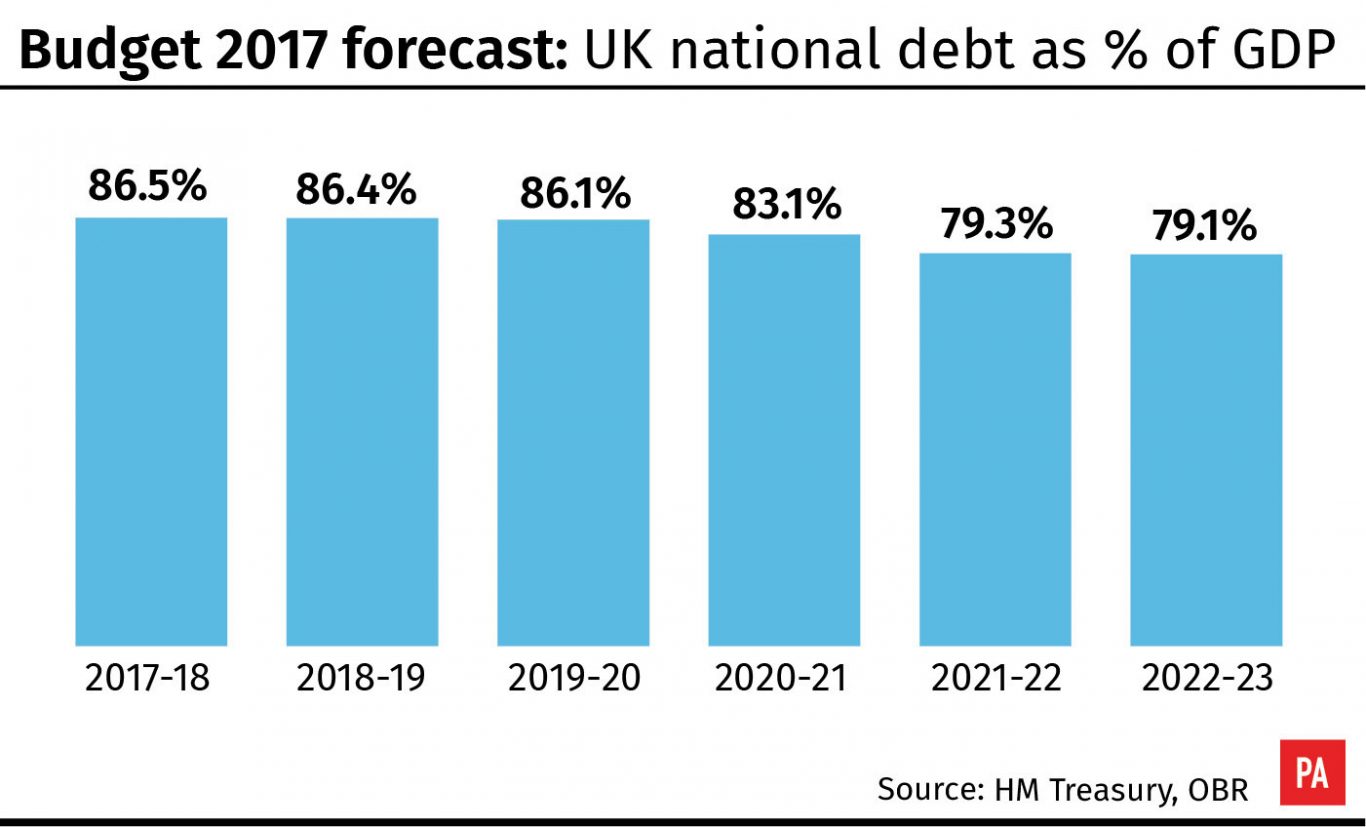

As a percentage of GDP, debt will peak at 86.5% this year before falling to 79.1% in 2022-23 – “the first sustained decline in debt in 17 years”.

The Budget watchdog noted that the UK economy has slowed this year as higher inflation squeezed household finances.

It added: “The persistence of weak productivity growth does not bode well for the UK’s growth potential in the years ahead.”

Mr Hammond had managed to meet his target of having net debt falling each year as a share of GDP largely by announcing fresh sales of RBS shares and by an accounting change relating to housing associations, said the OBR.

Other measures announced include a cut from six to five weeks in the waiting time for new Universal Credit claims; a freeze on alcohol duties and the cancellation of a planned rise in fuel duty.

From April, business rates will increase in line with the CPI rate of inflation rather than the higher RPI rate – a shift that was not due to come in for another two years – saving firms £2.3 billion over the next five years.

He also set out measures to compensate firms affected by the so-called “staircase tax” which hits firms with premises on different floors of a building.

And in an effort to tackle tax-dodging by multinational online firms, income tax will be applied to royalties relating to UK sales, raising about £200 million a year.

Labour leader Jeremy Corbyn condemned the Budget, saying it amounted to a “record of failure with a forecast of more to come”.