Fraud crimes up by 25% in two years, figures suggest

The Office for National Statistics said there were 4.5 million fraud offences in the year to March 2022.

The number of people falling prey to fraud has risen by 25% in the past two years, with 4.5 million offences in a 12-month period, figures have suggested.

Large increases were seen in the number of scams where money is paid up front in return for the promise of cash or a job, or goods or services, that fail to materialise, the Office for National Statistics (ONS) said.

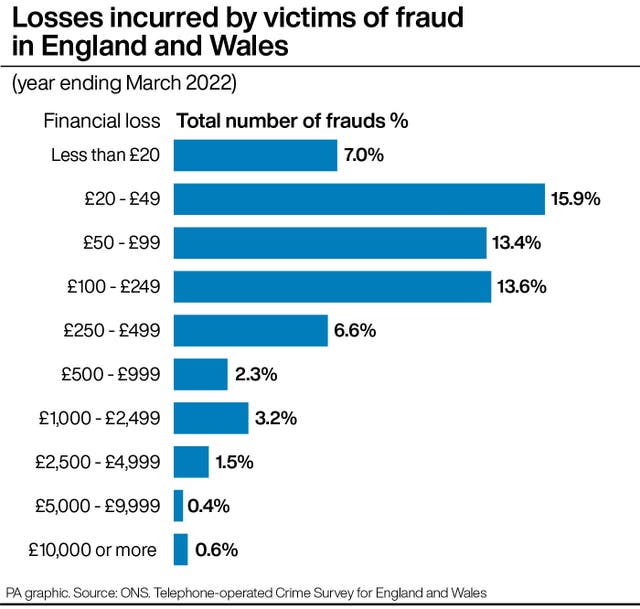

Most victims who lost money – around three-quarters – had less than £250 stolen; around 14% lost between £250 and £999; and the remaining 9% lost £1,000 or more.

Estimates drawn up by the ONS using data from the Crime Survey for England and Wales – a poll of members of the public and their experiences of crime – suggested there were 4.5 million fraud offences in the year to March 2022, up 25% on two years earlier.

The rise in fraud was also reflected in police-recorded crime, with a 17% rise in the year to March 2021 compared to the previous 12 months, and a 25% increase in the year to March 2022 compared to two years earlier.

The proportion of fraud offences classed as cyber-related also rose from 53% in the year to March 2020, to 61% in the year to March 2022, the crime survey showed.

Computer misuse increased by 89% to 1.6 million offences between the year to March 2020 and March 2022, driven by a surge in criminals accessing personal information.

The most common method was phishing messages, mostly pretending to be from a delivery company or bank.

Hacking more than doubled between the year to March 2020 and March 2022 to 1.3 million offences, having remained largely level in the previous three years.

Action Fraud, the national fraud and cybercrime reporting centre, reported an 11% fall in fraud to 354,758 offences in the year to March 2022 compared to the previous year.

This was fuelled by a drop in reported consumer and retail fraud.

UK Finance, which represents the banking industry, reported a 151% rise in fraud to 246,285 offences in the same time period, although this was put down to increased reporting by existing members and reports coming in from new members who joined in late 2021.