Sweet snacks tax may bring even greater benefits than soft drinks levy – study

Researchers have estimated that taxing sweet snacks could have a knock-on effect on the buying of soft drinks, biscuits, cakes and savoury snacks.

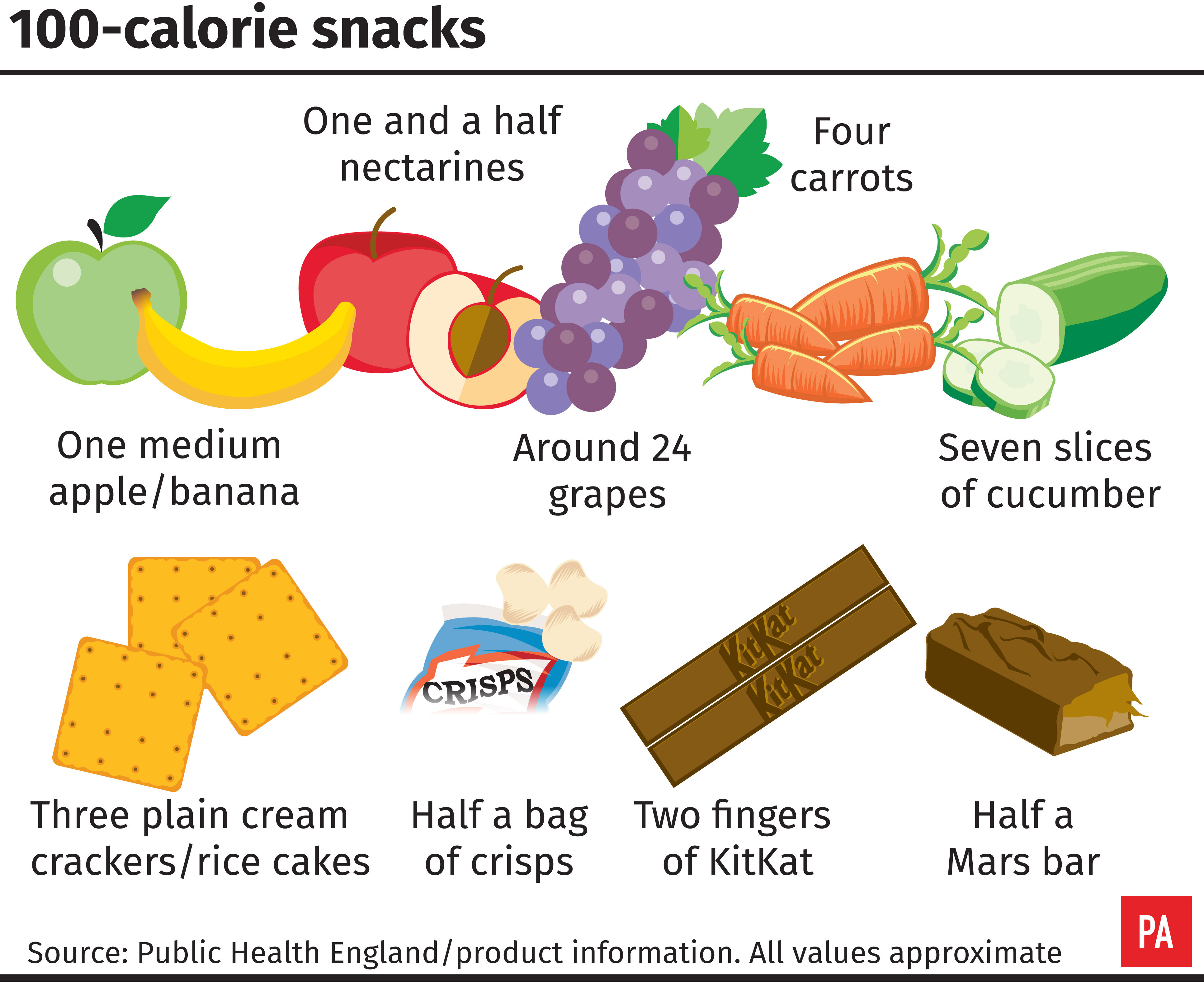

A 10% tax on sweet snacks could lead to a greater overall reduction in sugar consumption than taxing soft drinks alone, according to a study.

Adding 10% to the price of chocolate, confectionery, cakes and biscuits could lead to a drop in purchases of around 7%, researchers from the London School of Hygiene & Tropical Medicine, the University of Cambridge and the University of Oxford have estimated.

However the latest study, published in BMJ Open, found that taxing sweet snacks could have an additional knock-on effect on the sale of other foods, leading to consumers cutting their buying of soft drinks, biscuits, cakes and savoury snacks as well.

The researchers found, for example, that increasing the price of chocolate snacks was estimated to result in a significant reduction in buying across most food categories, while a price increase on biscuits showed a potential reduction in the purchase of cakes (2.3%) as well as chocolate and confectionery (1.7%).

The authors said the study was observational and they could not explain why consumers changed their buying behaviour.

“However, there has been little research on the impact that a similar price increase on other sweet foods such as chocolate, confectionery, cakes and biscuits could have on the purchase of sugar.

“This research suggests that taxing these sweet snacks could bring even greater health gains and warrants detailed consideration.”

Co-author Professor Susan Jebb, from the University of Oxford, said: “It’s impossible to study the direct effects of a tax on snack food on consumer behaviour until such policies are introduced, but these estimates show the likely impact of changes in the price.

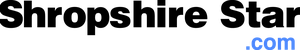

“These snacks are high in sugar but often high in fat too and very energy dense, so their consumption can increase the risk of obesity.

“This research suggests that extending fiscal policies to include sweet snacks could be an important boost to public health, by reducing purchasing and hence consumption of these foods, particularly in low-income households.”