Household disposable income down 1.4% for start of year

The savings ratio has also hit its lowest level since records began more than 50 years ago.

British households faced a sustained squeeze on their finances at the start of the year as disposable incomes shrank and the amount set aside for savings hit record lows.

The Office for National Statistics (ONS) said real household disposable incomes fell by 1.4% in the first three months of the year, declining for the third quarter in a row.

The savings ratio also sank to 1.7% in the first quarter, down from 3.3% in the final three months of last year and hitting its lowest level since records began more than 50 years ago.

Consumers have seen their spending power come under increasing pressure from soaring inflation triggered by the collapse of the pound following Britain’s vote to leave the European Union.

The ONS said household spending had slipped to 0.4% in the first three months of this year, from 0.7% in the fourth quarter of last year.

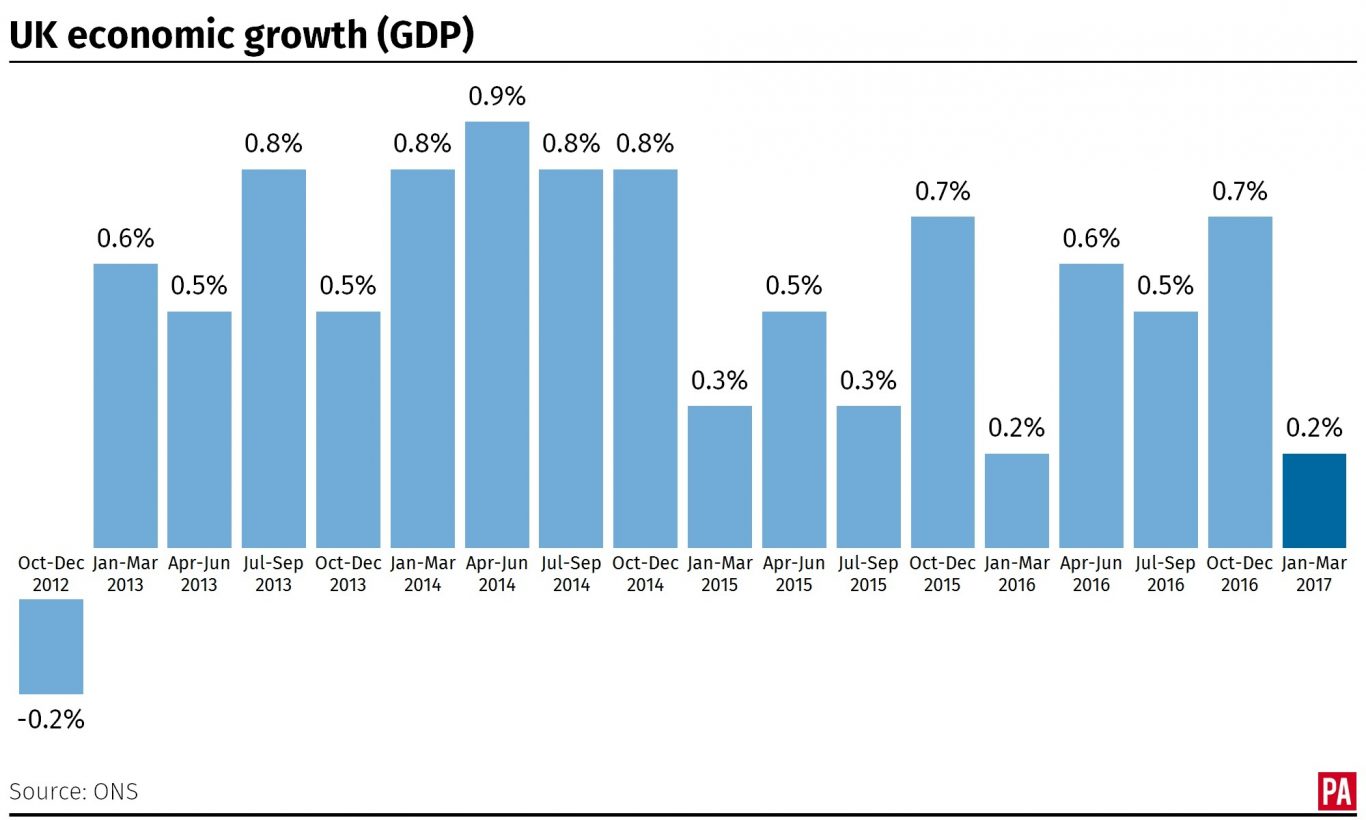

Despite signs that shoppers are raiding money normally earmarked for their nest eggs in order to keep spending, the statistics agency said the UK economy still only grew by 0.2% in the first quarter.

Darren Morgan, ONS head of GDP, said: “GDP growth for the first three months of 2017 remained unrevised at 0.2%.

“Growth was driven by business services and construction, partially offset by declines in some consumer-focused industries, such as retail sales and accommodation.

“The saving ratio has fallen again this quarter to a new record low, partly as a result of higher tax payments, reducing disposable income.

“Some of the fall could be as a result of the timing of those payments, but the underlying trend is for a continued fall in the saving ratio.”

Inflation hit its highest level in nearly four years at 2.9% in May, with the Bank of England expecting the cost of living to peak at 3% by the autumn.

The Bank’s Governor Mark Carney stressed the Monetary Policy Committee’s tolerance was limited when it came to inflation sitting above the Bank’s 2% target. He also hinted on Wednesday that interest rates could rise from record lows of 0.25% if wages firm and the economy is boosted by stronger business investment.